Doximity buys Pathway Medical for $63 million to help doctors get AI-powered answers

Doximity has acquired the AI startup Pathway Medical for $63 million. Pathway has one of the largest structured datasets in medicine, Doximity said. The integration is underway, and the companies are testing a combined product in beta with thousands of doctors

Scaling Private Impact Investing in Canada: Reflections from the Sustainable Finance Summit 2025

Amplify Capital adds Craig Hunter as partner while raising its third impact-focused fund

Fund III is now set to “multiply” Amplify’s impact, Hunter said in the post, now looking to lead, co-lead, or follow into pre-seed, seed, and Series A rounds across North America with cheques ranging from $1 million to $3 million.

Reusables: Why We Invested

Reusables is addressing this problem with a technology-driven, closed-loop reusable container system tailored for institutional food services. The company has built a frictionless, deposit-free, and container-agnostic system that enables institutions like universities, hospitals, and stadiums to transition away from single-use plastic seamlessly.

Cerula Care: Why We Invested

Cerula’s platform uses patient stratification and clinical workflow automation to ensure timely and effective support. By embedding mental health care into the cancer treatment journey, Cerula significantly enhances patient outcomes and quality of life.

Kento Health: Why We Invested

The Kento app, a proprietary AI-powered platform, offers personalized clinical exercise, nutrition and behavioural health plans, via expert clinical coaching and real-time continuous vitals monitoring. Its comprehensive heart disease management platform replaces or supplements traditional in-person care, and guides people through their recovery journey, all from the convenience of their home.

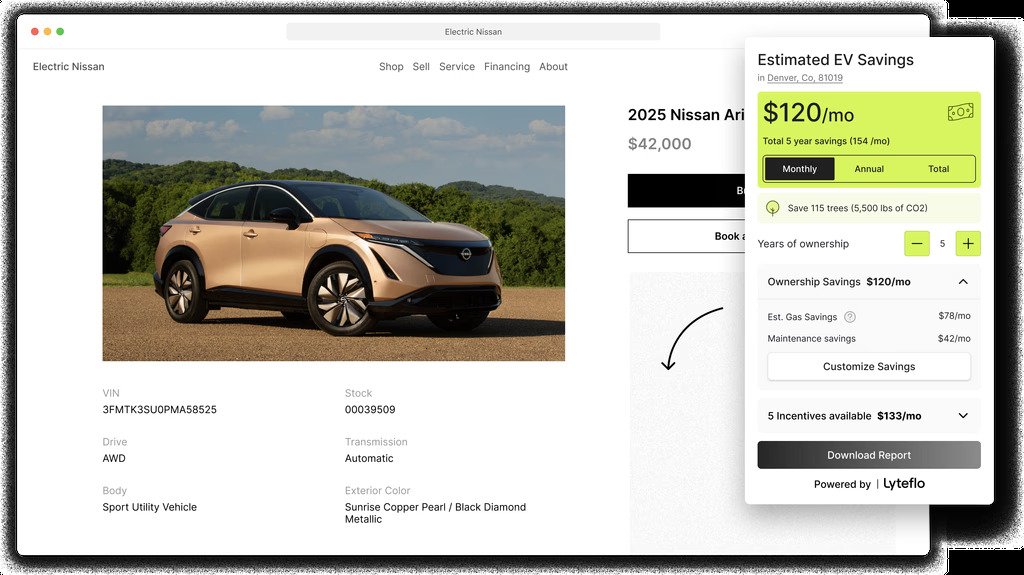

Lyteflo: Why We Invested

Lyteflo's emergence represents a significant advancement in addressing these market inefficiencies. Their comprehensive EV intelligence platform introduces sophisticated solutions to longstanding industry challenges.

Lyteflo Closes $3 Million Seed Round to Revolutionize Electric Vehicle Sales

Lyteflo Closes $3 Million Seed Round to Revolutionize Electric Vehicle Sales

Lyteflo, a new electric vehicle (EV) merchandising solution, today announced $3 million in Seed funding.

Planetary Technologies: Why We Invested

Planetary offers a scalable, natural alternative to engineered carbon removal solutions by enhancing the ocean’s existing ability to absorb CO2. The ocean already absorbs 31% of global CO2 emissions, and by adding alkalinity, Planetary increases this capacity while neutralizing ocean acidity. The process, called Ocean Alkalinity Enhancement (OAE), stores carbon as stable salts within the marine ecosystem for thousands of years, making it a low-energy, cost-effective, durable solution. Early tests in controlled environments confirm successful CO2 removal, and ongoing open-ocean trials show no measurable negative impact on marine habitats.

ThinkLabs AI is a specialized AI development and deployment company focused on advanced engineering systems. With their flagship product, ThinkLabs Copilot, using proprietary physics-informed AI digital twins, ThinkLabs AI is well positioned to transform the way grids operate, rich of clean data and predictive power.

Ottawa Announces Second Tranche of VCCI Funding to Support Underrepresented Entrepreneurs

An additional five VCs from Vancouver, Toronto, and Montréal will receive portions of the $25 million commitment.

The Canadian government announced the second tranche of $25 million in VCCI funding to support underrepresented entrepreneurs, including women, Indigenous, Black, and 2SLGBTQI+ communities. This funding will benefit five venture capital firms, including Amplify Capital. Amplify Capital's managing partner, Kathryn Wortsman, highlighted that our focus remains on achieving strong financial returns alongside measurable impact.