Reusables: Why We Invested

Reusables is addressing this problem with a technology-driven, closed-loop reusable container system tailored for institutional food services. The company has built a frictionless, deposit-free, and container-agnostic system that enables institutions like universities, hospitals, and stadiums to transition away from single-use plastic seamlessly.

Cerula Care: Why We Invested

Cerula’s platform uses patient stratification and clinical workflow automation to ensure timely and effective support. By embedding mental health care into the cancer treatment journey, Cerula significantly enhances patient outcomes and quality of life.

Kento Health: Why We Invested

The Kento app, a proprietary AI-powered platform, offers personalized clinical exercise, nutrition and behavioural health plans, via expert clinical coaching and real-time continuous vitals monitoring. Its comprehensive heart disease management platform replaces or supplements traditional in-person care, and guides people through their recovery journey, all from the convenience of their home.

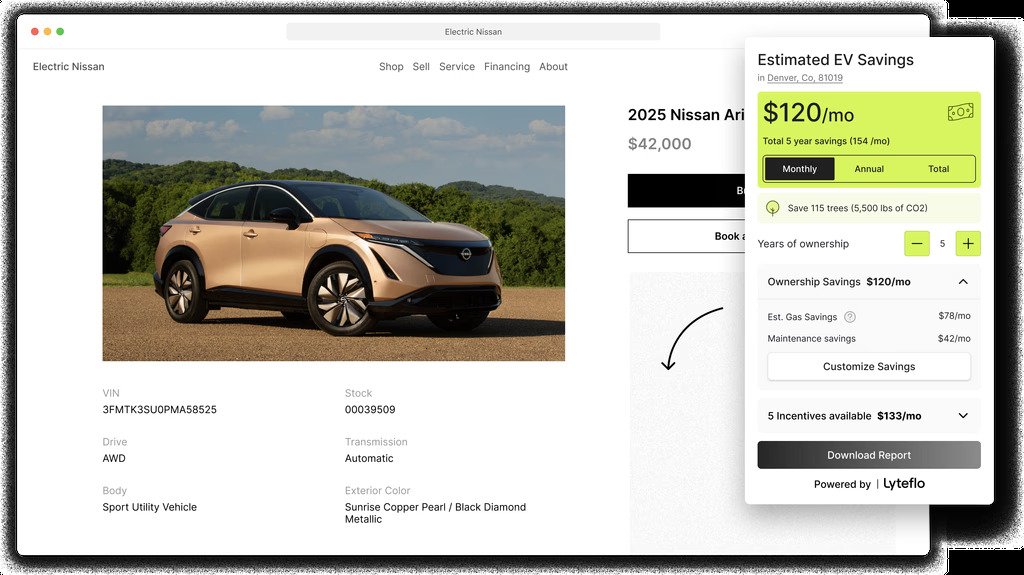

Lyteflo: Why We Invested

Lyteflo's emergence represents a significant advancement in addressing these market inefficiencies. Their comprehensive EV intelligence platform introduces sophisticated solutions to longstanding industry challenges.

Planetary Technologies: Why We Invested

Planetary offers a scalable, natural alternative to engineered carbon removal solutions by enhancing the ocean’s existing ability to absorb CO2. The ocean already absorbs 31% of global CO2 emissions, and by adding alkalinity, Planetary increases this capacity while neutralizing ocean acidity. The process, called Ocean Alkalinity Enhancement (OAE), stores carbon as stable salts within the marine ecosystem for thousands of years, making it a low-energy, cost-effective, durable solution. Early tests in controlled environments confirm successful CO2 removal, and ongoing open-ocean trials show no measurable negative impact on marine habitats.

ThinkLabs AI is a specialized AI development and deployment company focused on advanced engineering systems. With their flagship product, ThinkLabs Copilot, using proprietary physics-informed AI digital twins, ThinkLabs AI is well positioned to transform the way grids operate, rich of clean data and predictive power.

ThinkLabs AI: Why We Invested

ThinkLabs AI is developing a physics-informed digital twin model, supporting human operations by offering autonomous modeling and orchestration of the power grid. These insights enable power grid operators to connect power from renewable sources to the grid faster and more efficiently, alleviating grid connection queues.

ThinkLabs AI is a specialized AI development and deployment company focused on advanced engineering systems. With their flagship product, ThinkLabs Copilot, using proprietary physics-informed AI digital twins, ThinkLabs AI is well positioned to transform the way grids operate, rich of clean data and predictive power.

BioIntelligence Technologies: Why We Invested

To catalyze industrial decarbonization, we must move away from energy-intensive manufacturing to more energy-efficient, low carbon footprint alternatives, such as bio-fermentation. Quebec-based BioIntelligence Technologies (BIT) provides solutions for reducing the carbon footprint in large-scale bio-manufacturing industries like chemical production, pharmaceuticals, cosmetics, and certain food applications. BIT's analytics can alleviate challenges in biomanufacturing by reducing production losses and increasing yields by 5-10% per batch. This improvement fosters the adoption of more sustainable manufacturing processes.

Redefining Returns: The Evolution of Venture Capital Into Impact Investing

Venture capitalists have traditionally focused on high returns and calculated risks. However, in today’s evolving market landscape, there’s a significant shift towards a more purpose-driven approach. Relying solely on financial gains is no longer sufficient. The demand from consumers, governments, and communities for investments that also yield environmental and social returns is growing. This is particularly crucial given the current state of our planet and the challenges faced by health and education systems. Impact investing emerges as a paradigm shift, redefining the fundamental principles of investment for double bottom-line returns.

Carbon Upcycling raises $26M Series A led by BDC Capital and Climate Investment

Carbon Upcycling Technologies, a leader in circular decarbonization solutions for hard-to-abate sectors, including cement, steel, and mining, has closed a US$26 million Series A funding round co-led by BDC Capital’s Climate Tech Fund and Climate Investment.

The syndicate includes strong participation from existing financial investors, Clean Energy Ventures, its angel investor collective CEVG, Amplify Capital, and strategic investors, Oxy Low Carbon Ventures, CRH Ventures, and Cemex Ventures, which are all enhancing their financial support with commitments to strategically-relevant projects.

Future Fields: Why We Invested

Future Fields optimizes the biomanufacturing process, enabling more opportunities for cost-effective alternative proteins. As a result, Future Fields will support the decarbonization industries while offering a scalable solution to meet food, pharmaceutical, and other urgent and necessary needs globally.